Dominik Pabis/Getty Images Do you want to buy clothes that are made in America? And are you willing to pay what it costs to help bring manufacturing jobs back to America -- and be once again able to buy quality goods that will last, in return for your money? Words and Actions Most Americans answer yes to the first question -- initially, at least. A New York Times poll last year found 46 percent of shoppers saying they would happily pay the same price -- or even a bit of a premium -- to own clothing made in America, as opposed to clothing made in China, Vietnam or another foreign country. Yet according to American-made apparel manufacturer Buck Mason, less than 3 percent of clothing is made in America. Why is this? Many products made in America sell for prices far higher than what similar products made elsewhere cost. What's more, even if you are willing to pay the premium for quality (the Times poll noted that 56 percent of Americans say American-made clothing is of higher quality than imports), Buck Mason laments: "it is virtually impossible to go to a mall anywhere, and find a high-quality, American-made garment" today. So there are really two problems for shoppers looking to "buy American" today. First, you can't find such goods to buy. Second, if you do find them, they cost too much. American Apparel One company trying to fix the first problem is Los Angeles-based American Apparel (APP). A vertically integrated clothing company (meaning it owns and operates its own retail stores, selling its own clothing), American Apparel makes its clothing in the U.S. and sells it here and abroad. Despite charging prices that can be twice the cost of imports, however, American Apparel has struggled to earn a profit. The company ran into difficulties with its financial auditor in 2010 and suffered through a Securities and Exchange Commission investigation as a result. Sales growth has been anemic; American Apparel is losing money; and at last report, the company was $235 million in debt. Adding existential crisis to injury, American Apparel just ousted CEO Dov Charney, setting the stage for a nasty lawsuit with him. Giant retailer Walmart (WMT) is having different difficulties with the made-in-America business model. You've probably heard that Walmart plans to spend an additional "$50 billion" over the next 10 years, buying American-made goods to sell in its stores. However, after contributing to the dearth of supply in the first place -- by pushing suppliers to cut prices, forcing many of them to close up shop in the U.S. and move manufacturing abroad -- Walmart is scrambling to find businesses that still make stuff in America, to stock its shelves and help it fulfill its promise. American Prices And what about the second part of the problem: price? With the falling cost of energy in the U.S. resulting from the shale oil boom, advances in manufacturing technology such as 3-D printing and rising cost of labor elsewhere, you'd think U.S.-made goods would be getting more cost-competitive. So why do they still cost so much? Buck Mason co-founder Sasha Koehn points the finger at the multiple links in the supply chain that clothing passes through today en route from manufacturer to retailer. If a T-shirt from Thailand sells for $10 wholesale, for example, then delivery to industry showrooms, sales to wholesalers, resales to retailers and final sales to consumers can push the price tag on that tee up past $50. Koehn notes that the garment industry standard is for prices to get marked up as much as 800 percent between manufacture and retail. A Modest Solution Buck Mason is challenging industry norms with a two-pronged approach. First, the company limits price mark-ups with a "direct-to-consumer" model, manufacturing clothing in-house, then selling over the Internet to customers. By cutting out the middleman, Koehn says he's able to hold its retail prices to just twice the cost of manufacturing -- rather than 800 percent. Still, as long as American workers are paid better wages than their counterparts overseas, made-in-USA prices will remain higher than American shoppers are used to paying. (Buck Mason sells jeans for $135, belts for $72, and T-shirts for $24.) With its cost structure as low as it can go, therefore, Buck Mason focuses its efforts on ensuring customers "get what they pay for." Paying up for high-quality raw materials, Buck Mason sources leather for its belts from a century-old tannery in Chicago, for example. Koehn says that Buck Mason gets its denim from a North Carolina plant that charges $16 a yard just for the fabric. On one hand, this helps preserve American jobs and the same manufacturing base Walmart says it wants to promote. On the other hand, the higher-quality materials, Koehn says, enable it to stand behind the promise that its "30 Year Belts" and "20 Year Boots" names imply. Will this business model work? If shoppers really do mean what they say about wanting to "buy American," it just might. .

Wednesday, December 31, 2014

Can America Make Stuff Anymore?

Tuesday, December 30, 2014

More Pain Ahead For Small Caps, Credit Suisse Says

As if small-caps needed any more bad news, here comes Credit Suisse predicting more pain ahead.

Credit Suisse strategists Lori Calvasina and Sara Mahaffy explain why:

January, we saw two very conflicting signals in our DRIVERs framework – alarmingly expensive valuations that called for a decline in small cap stock prices over the next year, alongside a robust economic forecast that called for mid-teen returns in the R2000. Today, the economic forecast is cloudy, and valuations remain highly problematic, with most major multiples in small cap still up around historical or post TMT bubble highs. The R2000 forward P/E was at 19.6x to start the year, and was sitting at 18.2x as of May 6th. In the 19x-20x range, small caps decline about 64% of the time over the next 12 months, for an average drop of 2%. In the 18-19x range, small caps have historically risen on a 12 month forward basis 64% of the time, but the average gain is 4%

Importantly, even though many individual growth stocks have been hit much harder, the Russell 2000 itself was only down 9.2% from its early March 2014 peak as of the May 8th close. While this move has felt painful to many investors, it is important to keep in mind that since the mid 1990′s the average and median pullbacks in the Russell 2000 have been 21% and 14%. Given the historical track record, we would not be surprised to see the Russell 2000 approach 1,000 (compared to its peak of 1,209 and recent close of 1,097) before a bottom is found.

The iShares Russell 2000 ETF (IWM) has dropped 5.2% so far this year, while Mueller Industries (MLI), which has plunged 55%, Medidata Solutions (MDSO), which has plummeted 44%, Financial Engines (FNGN), which has slid 42%, and Isis Pharmaceuticals (ISIS), which has tumbled 42%, are the index’s biggest losers.

Monday, December 29, 2014

Why Envivio (ENVI) Stock Is Up In Aftermarket Trading Today

NEW YORK (TheStreet) -- Envivio Inc (ENVI) shares were up 12.1% to $3.70 in aftermarket trading Tuesday.

The bump comes following the company's announcement that it had come to terms on a deal with Apple (AAPL) to power premium live HD sports channels on Apple TV for a European Tier 1 service provider.

Must Read: Warren Buffett's 10 Favorite Stocks

STOCKS TO BUY: TheStreet Quant Ratings has identified a handful of stocks that can potentially TRIPLE in the next 12 months. Learn more.

"We are the leaders in adaptive bitrate compression and video processing innovations for Internet and over-the-top TV, and continue to enhance our solutions by providing support for a broad range of devices and formats, including Apple TV and the related content protection technologies," said Envivio's president and CEO Julien Signes. TheStreet Ratings team rates ENVIVIO INC as a Sell with a ratings score of D. TheStreet Ratings Team has this to say about their recommendation: "We rate ENVIVIO INC (ENVI) a SELL. This is driven by several weaknesses, which we believe should have a greater impact than any strengths, and could make it more difficult for investors to achieve positive results compared to most of the stocks we cover. The area that we feel has been the company's primary weakness has been its disappointing return on equity." Highlights from the analysis by TheStreet Ratings Team goes as follows: The return on equity has improved slightly when compared to the same quarter one year prior. This can be construed as a modest strength in the organization. Compared to other companies in the Software industry and the overall market, ENVIVIO INC's return on equity significantly trails that of both the industry average and the S&P 500. The gross profit margin for ENVIVIO INC is rather high; currently it is at 66.80%. It has increased from the same quarter the previous year. Regardless of the strong results of the gross profit margin, the net profit margin of -16.34% is in-line with the industry average. ENVI has no debt to speak of therefore resulting in a debt-to-equity ratio of zero, which we consider to be a relatively favorable sign. Along with this, the company maintains a quick ratio of 3.14, which clearly demonstrates the ability to cover short-term cash needs. This stock has increased by 68.30% over the past year, outperforming the rise in the S&P 500 Index during the same period. Regarding the future course of this stock, we feel that the risks involved in investing in ENVI do not compensate for any future upside potential, despite the fact that it has seen nice gains over the past 12 months. ENVIVIO INC reported significant earnings per share improvement in the most recent quarter compared to the same quarter a year ago. The company has demonstrated a pattern of positive earnings per share growth over the past year. We feel that this trend should continue. This trend suggests that the performance of the business is improving. During the past fiscal year, ENVIVIO INC continued to lose money by earning -$0.46 versus -$0.63 in the prior year. This year, the market expects an improvement in earnings (-$0.28 versus -$0.46). You can view the full analysis from the report here: ENVI Ratings Report STOCKS TO BUY: TheStreet Quant Ratings has identified a handful of stocks that can potentially TRIPLE in the next 12 months. Learn more.

Stock quotes in this article: ENVI, AAPLUnited Capital Launches Liquidity Program for Advisors

United Capital announced Monday a liquidity program that allows advisors who have been with the firm for at least six years to convert up to 25% of holdings in company stock to cash.

“We’ve been growing the company now for going on nine years, and virtually all of the advisors who join us, join us through a sale of their previous business,” Gary Roth, CFO of United Capital, told ThinkAdvisor on Thursday. He noted that those advisors typically take a portion — “sometimes a very substantial portion” — of the purchase price in stock.

“We thought it was the right time to start a program internally to create some liquidity for the people who have been holding the shares for at least six years,” he said.

United Capital announced the program to its advisors in the fourth quarter of last year and began the first round of liquidity in January and February.

Clive Cholerton, a managing director with United Capital based in Boca Raton, Fla., was one of the advisors who participated. He joined the firm in February 2007.

“When United purchased my independent practice, part of the deal was I took stock in the company,” Cholerton told ThinkAdvisor. “Now, this event gave me the opportunity to realize some of the actual investment that I had in the company.”

Cholerton said that he first heard of United Capital when he hired Angie Herbers (who is a writer for Investment Advisor and ThinkAdvisor) as an independent consultant as he tried to separate his partnership with accounting firms who were minority shareholders. “We started to realize that our paths were going in different directions, so we looked for a way of unwinding the partnership,” he said. “What was so appealing to me was here was a company that was doing exactly what I wanted to be doing, only doing it better, and with bigger and better toys.”

Roth, who is based at the firm’s headquarters in Newport Beach, Calif., noted that the firm recently acquired a round of private equity capital. “The vast majority of that is earmarked toward other acquisitions and new growth strategies, but we all agreed to use a portion of the money on our balance sheet to create a liquidity pool for our advisors,” he said.

Advisors can only cash out up to 25% of their holdings in United Capital stock because, as Roth said, “the goal isn’t to cash people out, per se, it’s just to allow people to take some chips off the table and diversify if they need to take care of some things in their lives.”

In fact, United Capital advisors are fairly young and not nearing retirement yet. Roth estimated the average advisor at the firm is likely “mid- to late 40s.”

Most advisors eligible for the program took advantage of it, but Roth said that the majority of those didn’t take the maximum allowed. “It’s a good validation for us that we were creating the flexibility for people to be able to create some liquidity, but when people had the option and did their own analysis, people felt really good about continuing to hold onto the stock,” he said.

Roth said the program will be an annual event. “Each year, a new group become eligible based on their tenure with the firm, so that the next priority will go to people who haven’t had a chance to sell anything yet and we’ll go from there.

“We’ve had terrific feedback from the people involved and terrific feedback from the people who will be eligible in the future. So far, it’s been one of the best-received programs that we’ve ever had.”

Cholerton noted that one of the benefits of the liquidity program is confidence in the firm. “Any time you go into any of these deals when some of it’s being paid for in stock,” he said, you have to ask yourself, “is that going to have value in the future?”

In the case of United Capital, he said, “Here’s a company that went through the financial downturn, still found a way to continue to grow revenue each and every one of those years, still has continued to build shareholder value at a very impressive rate. For me as a shareholder, when you take that leap of faith going into it, it’s nice to see it realized.”

Sunday, December 28, 2014

How Much Will the Health Insurance Penalty Cost You?

Karen Bleier, AFP/Getty Images We are well aware of the rocky start of the HealthCare.gov website, the confusion and inconvenience surrounding health insurance enrollment and the reluctance of many to accept the premise of "health care coverage for all." If you have decided not to purchase a health insurance plan, you should learn the specifics of the penalty, formally referred to as the individual shared responsibility payment, so that you aren't surprised when you're hit with a monetary fine. No penalty for me. Many Americans do not have to worry about the penalty. If you have health insurance coverage through your employer, are covered by Medicaid or Medicare, or you have already purchased your own insurance through a private provider, you have no reason to worry. There is no failure-to-insure fine in your future. If you can't afford health insurance, you don't have to pay the penalty either. The Affordable Care Act allows an exclusion if the lowest-priced coverage available will cost you more than 8 percent of your household income. Additional hardship exemptions are also available and include events such as filing for bankruptcy or being evicted in the past six months. However, if you can afford health insurance and still decline to buy it, you will be responsible not only for the payment of any health care expenses that arise, but also owe a penalty to the Internal Revenue Service. Calculating the penalty. This year, the penalty is $95 per adult and $47.50 per child with a maximum of $285 per household -- or 1 percent of income, whichever is greater. The income calculation is based on 1 percent of your adjusted gross income that exceeds your personal exemption and standard deduction. For example, if you are married, filing jointly and your AGI is $50,000, less the standard deduction of $20,000, the penalty would be assessed on $30,000. So a 1 percent penalty would equal $300. Do the math for me. If you would rather have someone else estimate the penalty you'll pay, there are some online tools available. We'll put one to work using this hypothetical: The U.S. Census Bureau estimates the median household income in the U.S. is $53,046, and the average household has 2.61 persons (we'll round up to three), as calculated for the years 2008 to 2012. Using TurboTax's penalty calculator, an average American family would pay a maximum penalty of $330.46 this year. This includes the three-month grace period of not having to pay the penalty through March 31, 2014. When the clock starts ticking. Open enrollment through the state government exchanges closes on March 31, 2014. After that deadline, you won't be able to get health coverage through the marketplace until the next open enrollment period (which, by the way, will be shorter next year -- Nov. 15, 2014 through Jan. 15, 2015). Exceptions are allowed for "qualifying life events," including moving to a new area that offers different plan options, an abrupt change in household income that affects eligibility for tax credits or changes in family size due yo marriage or the birth of a child. Keep in mind that if you are uninsured, you only owe a penalty for the months you are without coverage after a three-month period, and the fee is pro-rated. for people who had insurance at some point during the year, If you do owe a penalty, it will be withheld from your 2014 tax refund. If the payment is not made, the IRS can withhold the amount from any future tax refunds, with an accrued interest of approximately 3 percent. However, the IRS cannot impose liens, levies or criminal penalties for failure to pay the penalty. As a further incentive to encourage enrollment in some kind of health care coverage, the ACA penalty increases in the years to come. For 2015, the annual penalty will increase to $325 per adult and $162.50 per child, with a maximum of $975 per family -- or 2 percent of AGI exceeding deductions and exemptions. In 2016, it will be $695 per adult and $347.50 per child, with a maximum penalty of $2,085 per family, or 2.5 percent of AGI exceeding deductions and exemptions. Successive years will see the penalty increase at a rate indexed to inflation.

2014: The Year of Cost Controls

On January 1, private coverage purchased through the state and federal health care exchanges will be taking effect, assuming consumers were able to navigate the bevy of technical glitches that plagued the federal system.

According to the Obama administration, more than 1.1 million people enrolled in coverage through the federal exchange site between October 1 and December 24, the last day that consumers could sign up and still receive coverage effective January 1.

That figure comes just shy of 1.2 million people the administration originally projected would sign up, but it also doesn’t include enrollment numbers from states that run their own exchanges or an estimate of how many Americans signed up for coverage under the expanded Medicaid program. That said, in early December the administration estimated that at least 803,000 people have been deemed eligible for Medicaid or the Children’s Health Insurance Program because of the ACA.

January 1 will also see the end of coverage restrictions based on pre-existing conditions as well as limiting how much insurers can boost coverage rates based on age, geography or tobacco use. Annual coverage limits will also come to an end.

The New Year also brings the individual mandate with it, though consumers have until March 31 (which is also the day open enrollment in the marketplaces ends) to have coverage in place before the penalties begin. Anyone without insurance by that date will face a fine of $95 or 1 percent of taxable income, whichever is higher, when they file their 2014 taxes. The penalty increases to $325 in 2015 and $695 by 2016.

Minimum coverage requirements, which were the driving factor behind the millions of policy cancellations a few months ago, are a! lso kicking in, forcing insurers to cover services such as hospitalization, pre- and post-natal care, mental health services and a whole host of others.

With the new rules now taking effect, we’ll finally begin seeing the steady ramp up in volume growth as a growing pool of insured patients enter the market with access to more services than before.

Unfortunately, though, some of those volume gains will be offset by cost control features of the ACA such as reimbursement pressures under both the Medicare and Medicaid programs, and industry taxes such as those on medical devices and new fees. So the biggest open question in the health care industry for 2014 will be just how big of a boost it will get from the ACA.

As I’ve written on numerous occasions, I look for the deepened patient pool to result in a net gain for most health care companies regardless of cost control pressures. But I suspect those companies that have less exposure will be the top performers at least in the first half of the year.

Express Scripts (NSDQ: ESRX) is one of those companies that is largely immune from cost control measures and will most likely even benefit from them.

It’s the largest pharmacy benefit manager in the US, serving more than 150 million patients and covering more than a third of all the prescriptions written either through local pharmacies or through its own mail-order pharmacy.

Given the bargaining power the company enjoys by virtue of its sheer size, it benefits from keeping prescription costs down and encouraging the shift to greater utilization of generic drugs which widens the company’s profit margins.

Operating margins have already been increasing for the company, up by nearly 2 percent in the company’s most recent quarter alone, while revenue on an adjusted claim basis increased by 6.5 percent. Operating profit shot up 17.3 percent, as more than 80 percent of the prescriptions it handled were higher margin generics.

Despite ! that soli! d performance, shares are currently trading at just 0.6 times trailing 12-month sales while its forward price-to-earnings (P/E) ratio is just 13.8 compared to its 30.4 P/E on a trailing basis.

I’ve been covering the company for more than two years now, having first noticed it when it was in a pricing dispute with Walgreen Company (NYSE: WAG) and working to complete a merger with Medco Health Solutions but there were concerns that the government might scuttle the deal. I haven’t seen the company’s shares this cheaply valued since then and it’s entirely due to investor worries over the ACA.

With the ACA set-up to be more of a help than a hindrance to Express Scripts’ business model, the stock is a buy up to 78.

Dr Reddy’s Laboratories (NYSE: RDY) will be another major beneficiary from both volume increases and cost controls.

It is the second-largest pharmaceutical company in India and a leading manufacturer of generic drugs. While nearly three quarters of the company’s revenues are sourced in India, its revenues here in North America grew by 43 percent in its second fiscal quarter of 2014.

That growth was almost entirely due to increased generics penetration, a trend that will only accelerate in 2014, particularly as Dr Reddy’s pushes into the biosimiliars market.

Biosimiliars are generic versions of biologic drugs such as Humira (a rheumatoid arthritis treatment) which are made from living microorganisms. About 150 biologic drugs are approved for use and many of them have lost patent protection over the past 18 months.

Dr Reddy’s is beginning to push into biosimiliars, taking on a European partner to begin marketing a biosimiliar drug in the region, a generic version of Johnson & Johnson’s (NYSE: JNJ) rheumatoid arthritis drug Remicade.

A successful entry there would bode well for the drug’s entry here in the US market, especially since the ACA created a streamlined process for a! pproving ! biosimiliar drugs shown to be essentially interchangeable with a biologic drug already approved by the FDA. The goal is to control costs in a class of drugs that are experiencing phenomenal growth, but which cost thousands of dollars per year largely due to the more complicated manufacturing processes.

With the ACA tailor made to encourage the growth of Dr Reddy’s Laboratories, the stock is a buy up to 43.

Saturday, December 27, 2014

Tesla’s Next Stop: Its 200-Day Moving Average?

With half an hour left in the day, shares of Tesla (TSLA) have plunged 11% to $120.69 and could target its 200-day moving average in the days ahead.

Take a look:

The Wall Street Journal’s Money Beat blog blames fires and valuation concerns for Tesla’s troubles, but those issues–particularly the latter–have been around for ages.

Now they seem to matter.

UPDATE: Bloomberg is reporting that Tesla is being investigated for an accident at its factory:

Tesla Motors Inc., the electric-car maker led by Elon Musk, fell as safety officials in California investigate an industrial accident at the company's sole Model S plant that injured three workers…

The company said Nov. 13 that three employees at its Fremont, California, plant were injured by hot metal resulting from a failure in "low-pressure" aluminum casting press. The incident, which Tesla has said won't cause production delays, is the latest in a string of mishaps for the electric-auto maker. Those include three Model S fires as well as its reported third-quarter deliveries that were lower than some analysts expected.

5 Stocks Under $10 Triggering Breakouts

DELAFIELD, Wis. (Stockpickr) -- At Stockpickr, we track daily portfolios of stocks that are the biggest percentage gainers and the biggest percentage losers.

>>5 Stocks Insiders Love Right Now

Stocks that are making large moves like these are favorites among short-term traders because they can jump into these names and try to capture some of that massive volatility. Stocks that are making big-percentage moves either up or down are usually in play because their sector is becoming attractive or they have a major fundamental catalyst such as a recent earnings release. Sometimes stocks making big moves have been hit with an analyst upgrade or an analyst downgrade.

Regardless of the reason behind it, when a stock makes a large-percentage move, it is often just the start of a new major trend -- a trend that can lead to huge profits. If you time your trade correctly, combining technical indicators with fundamental trends, discipline and sound money management, you will be well on your way to investment success.

>>5 Big Trades for a Market Top

With that in mind, let's take a closer look at a several stocks under $10 that are making large moves to the upside.

Mueller Water Products

Mueller Water Products (MWA) is a manufacturer and marketer of a broad range of water infrastructure, flow control and piping component system products for use in water distribution networks and water treatment facilities in North America. This stock closed up 2.3% to $7.83 in Thursday's trading session.

Thursday's Range: $7.61-$7.84

52-Week Range: $3.83-$8.13

Thursday's Volume: 1.04 million

Three-Month Average Volume: 1.37 million

>>5 Cash-Rich Stocks to Triple Your Gains

From a technical perspective, MWA trended modestly higher here right above its 50-day moving average of $7.43 with decent upside volume. This stock has been uptrending strong for the last two months and change, with shares moving higher from its low of $6.02 to its recent high of $8.13. During that move, shares of MWA have been making mostly higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of MWA within range of triggering a near-term breakout trade. That trade will hit if MWA manages to take out its 52-week high at $8.13 with high volume.

Traders should now look for long-biased trades in MWA as long as it's trending above its 50-day at $7.43 or above more key near-term support levels at $7.29 to $7.16 and then once it sustains a move or close above its 52-week high at $8.13 with volume that hits near or above 1.37 million shares. If that breakout hits soon, then MWA will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $10 to $12.

Inteliquent

Inteliquent (IQNT) provides wholesale voice services for carriers and service providers. This stock closed up 2.2% to $8.25 in Thursday's trading session.

Thursday's Range: $7.92-$8.39

52-Week Range: $2.10-$11.30

Thursday's Volume: 608,000

Three-Month Average Volume: 704,432

>>4 Big Tech Stocks on Traders' Radars

From a technical perspective, IQNT trended modestly higher here right above its 50-day moving average of $7.24 with decent upside volume. This stock has been uptrending strong for the last month, with shares moving higher from its low of $5.73 to its intraday high of $8.39. During that move, shares of IQNT have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of IQNT within range of triggering a major breakout trade. That trade will hit if IQNT manages to take out some near-term overhead resistance levels at $8.54 to $9.07 with high volume.

Traders should now look for long-biased trades in IQNT as long as it's trending above its 50-day at $7.24 or above more near-term support at $7.01 and then once it sustains a move or close above those breakout levels with volume that hits near or above 704,432 shares. If that breakout hits soon, then IQNT will set up to re-test or possibly take out its next major overhead resistance levels at $10 to $12.

Cache

Cache (CACH) is a mall-based specialty retailer of lifestyle sportswear and dresses targeting style-conscious women. This stock closed up 7.1% to $4.82 in Thursday's trading session.

Thursday's Range: $4.48-$4.84

52-Week Range: $1.59-$4.99

Thursday's Volume: 117,000

Three-Month Average Volume: 71,035

>>4 Stocks in Breakout Territory on Big Volume

From a technical perspective, CACH ripped higher here right off its 50-day moving average of $4.52 with above-average volume. This move is quickly pushing shares of CACH within range of triggering a big breakout trade. That trade will hit if CACH manages to take out its 52-week high at $4.99 and some past resistance at $5 with high volume.

Traders should now look for long-biased trades in CACH as long as it's trending above some key near-term support at $4.40 and then once it sustains a move or close above those breakout levels with volume that hits near or above 71,035 shares. If that breakout triggers soon, then CACH will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $6 to $6.50.

Westell Technologies

Westell Technologies (WSTL) designs, manufactures and distributes telecommunications products to telephone companies and other telecommunications service providers. This stock closed up 6.9% to $3.09 in Thursday's trading session.

Thursday's Range: $2.89-$3.10

52-Week Range: $1.73-$3.15

Thursday's Volume: 153,000

Three-Month Average Volume: 190,163

>>3 Huge Stocks to Trade (or Not)

From a technical perspective, WSTL ripped higher here right above some near-term support at $2.82 with lighter-than-average volume. This stock has been uptrending strong for the last four months, with shares pushing higher from its low of $1.90 to its recent high of $3.15. During that uptrend, shares of WSTL have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of WSTL within range of triggering a near-term breakout trade. That trade will hit if WSTL manages to take out Thursday's high of $3.10 and then its 52-week high at $3.15 with high volume.

Traders should now look for long-biased trades in WSTL as long as it's trending above some key near-term support levels at $2.82 or its 50-day at $2.71 and then once it sustains a move or close above those breakout levels with volume that hits near or above 190,163 shares. If that breakout triggers soon, then WSTL will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $3.60 to $4.

Dolan

Dolan (DM) is a provider of necessary business information and professional services to the legal, financial and real estate sectors in the U.S. This stock closed up 6.2% to $2.20 in Thursday's trading session.

Thursday's Range: $2.05-$2.23

52-Week Range: $1.37-$5.73

Thursday's Volume: 184,000

Three-Month Average Volume: 293,875

>>5 Rocket Stocks to Buy This Week

From a technical perspective, DM jumped higher here right above some near-term support at $2 and back above its 50-day moving average at $2.08 with lighter-than-average volume. This stock has been trending sideways and consolidating for the last month, with shares moving between $1.95 on the downside and $2.35 on the upside. Shares of DM are now starting to move within range of triggering a near-term breakout trade above the upper end of its recent sideways trading chart pattern. That breakout will hit if DM manages to take out some near-term overhead resistance levels at $2.25 to $2.35 with high volume.

Traders should now look for long-biased trades in DM as long as it's trending above its 50-day at $2.08 or above more near-term support at $2 to $1.95 and then once it sustains a move or close above those breakout levels with volume that hits near or above 293,875 shares. If that breakout triggers soon, then DM will set up to re-test or possibly take out its next major overhead resistance levels at its 200-day moving average of $2.60 to $2.84. Any high-volume move above those levels will then put $3 to $3.20 into range for shares of DM.

To see more stocks that are making notable moves higher today, check out the Stocks Under $10 Moving Higher portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>4 Stocks Rising on Unusual Volume

>>5 Hated Earnings Stocks You Should Love

>>5 Stocks Under $10 Set to Soar

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.Friday, December 26, 2014

Opting out of Employees' Provident Fund not a good idea

Below is the verbatim transcript of Roongta's interview with CNBC-TV18.

Q: Is it a good idea to voluntarily increase employees' provident fund (EPF) allocation, but on the flipside would is it advisable to opt out of contributing EPF?

A: Very few people are aware that one can opt out of an EPF when one is joining at a new job and is not covered in the definition of an employee.

The key is should one opt out. I do not think one should opt out because what employer's contribute, up to 12 percent of basic salary is exempt from tax and that earns 8.5 percent and is completely tax free and it also requires a matching contribution from employee side, which is again deductible for tax purposes plus the interest earned on that is exempt, there is a compulsory saving, a retirement corpus gets built. Therefore, EPF is a great thing which even if one has the option to opt out of; one should not opt out of.

Caller Q: My goal is wealth creation and I can invest Rs 6,000 a month. How can I allocate this money?

A: It seems this is extra money and there is no serious liquidity requirement on this and it is something that you can do long-term and if that is true then bigger allocation to equity even as much as 90 percent is something that can be recommended. You can put it through a systematic investment plan in a largecap fund. Therefore, you are put Rs 5,000-5,500 in a largecap fund or you can put Rs 5,000 in provident fund or gold fund. The choice is yours.

However, the key to this is discipline. Continuously keep on doing this month after month, do not look at what is happening to the net asset value (NAV). Over a long period of ten years it should give you excellent returns. Assuming returns of 14 percent, Rs 6,000 a month can become as high as Rs 15 lakh to Rs 16 lakh.

Funds that I can recommend on the largecap side could be Franklin India Bluechip Fund , HDFC Equity Fund or any other largecap fund possibly even an index fund, if that is what you like.

Thursday, December 25, 2014

Don't Ignore This Risk When Investing in SodaStream

In the video below, Motley Fool analyst Blake Bos highlights the geographic risks that follow an investment in Soda Stream (NASDAQ: SODA ) -- specifically, the company's Israel location and its manufacturing plant in the volatile West Bank.

A controversial video about the company called "Breaking Barriers" has been released, which highlights the company's positive work environment meant to bring together Palestinians and Israelis alike. At this time, a lack of credible news regarding this video has clouded the truth behind the company's statements. Blake determines the video is of little significance as the employees at this facility are content with current working conditions.

Blake warns investors of the risk related to a major conflict eruption in the region. Although unlikely, he believes shares will be weighed down slightly by this risk for the foreseeable future. Investors should refrain from investing large parts of their portfolios in companies that have large country-specific risks, and should always take these risks into account before starting a position. Blake has allocated only 5% of his portfolio in the company to protect against any conflict.

As Blake mentions in the video, Soda Stream's country specific risks may affect the company's bright future greatly. The Motley Fool's premium report on SodaStream explains the opportunities as well as the risks in the company. The report comes with a year's worth of updates, so just click here to get started.

Minor News Moves Citigroup Up

On a day when the markets are otherwise flat, Citigroup (NYSE: C ) shares are trading up roughly 0.5% halfway through the trading day, seemingly on no news other than some changes at some senior positions at the bank. The stock move is slightly less than its median daily move over the past 12 months, so it was to be expected, but let's take a closer look at those changes and what they could mean for the future of the bank.

But first, the sector

The rest of the Big Four banks have also stayed put for the most part this morning:

Citigroup shouldn't react as much as the others to housing data set to be released this week, but it doesn't make that information any less important for people that keep an eye on banks. As the overall economy continues to improve -- housing is only one measure to look at -- profits at big banks should continue to reap the rewards.

Senior shuffling at Citi

With the departure of CitiMortgage CEO Sanjiv Das planning on leaving the bank to pursue "other opportunities," Citibank CEO Michael Corbat announced a new leader at that division, prompting a shuffling of the deck at some of Citibank's most senior positions. Jane Fraser will move from the CEO seat at Citi's private bank into Das' old position. Mark Mason, current CEO of Citi Holdings, will take over the private bank, while Francesco Vanni d'Archirafi goes to Citi Holdings.

Citi Holdings could perhaps be the most important position of these moves, as the division manages all of the non-core assets that Citigroup is winding down or selling. At the end of the previous quarter, Citi Holdings accounted for 8% of the bank's total assets, a fairly significant amount. Vanni d'Archirafi will look to continue the work of Mason, who managed to reduce the account 29% over the previous year, allowing the bank to continue to focus on its core businesses.

Citigroup's stock looks tantalizingly cheap. Yet the bank's balance sheet is still in need of more repair, and there's a considerable amount of uncertainty after a shocking management shakeup. Should investors be treading carefully, or jumping on an opportunity to buy? To help figure out whether Citigroup deserves a spot on your watchlist, I invite you to read our premium research report on the bank today. We'll fill you in on both reasons to buy and reasons to sell Citigroup, and what areas Citigroup investors need to watch going forward. Click here now for instant access to our best expert's take on Citigroup.

Wednesday, December 24, 2014

CES Synergies is Sittin' Pretty Headed Into 2015 (CESX, JEC, CBI)

If the forecasters are on target (and they usually are), then construction and engineering names like Jacobs Engineering Group Inc. (NYSE:JEC) and Chicago Bridge & Iron Company N.V. (NYSE:CBI) should have a very solid 2015. Construction in the United States, and heavy construction in particular, is projected to grow in the coming year, setting up something of a boost for tickers like CBI and JEC. Chicago Bridge & Iron Company and Chicago Bridge & Iron Company N.V. aren't the only ways to play the trend, however. In fact, the blatant obviousness of them as beneficiaries likely saps some of their upside for newcomers. Investors looking for the bigger opportunities built into the positive construction outlook may want to consider the names that also - but quietly - benefit from rising construction activity... off-the-radar names like CES Synergies Inc. (OTCBB:CESX).

CES Synergies, through its subsidiary Cross Environmental Services - is a demolition and abatement experts, knocking down buildings, cleaning up demolition debit, and even removing asbestos before a major remodel (major, as in schools and hospitals) can be done before companies like the aforementioned Jacobs Engineering Group and Chicago Bridge & Iron Company N.V. can get to work on their part of the project.

It's an aspect of the construction market that often goes unappreciated, though it shouldn't. While most new homes are built in open, undeveloped tracts of land, most major institutional-level construction takes place where existing structures and infrastructure is in place. That tear-down work must be handled with care, and also in accordance with ever-rising EPA standards.

As an example, in November the Environmental Protection Agency is considering changes to its Lead Renovation, Repair and Painting Program (LRRP) rules that cover construction work on existing public and private-sector commercial (P&C) buildings. Some of the proposed revisions include lowering the limit for the tolerable amount of lead used in manufactured or imported paints, imposing stricter scrutiny regarding the disposal of polychlorinated biphenyls, asbestos, radon and lead-based paint and instituting more stringent training and certification requirements for workers that remodel, repair or paint child-occupied buildings. The measures' would ultimately add to the cost of much of the construction work inside/outside existing P&C buildings, including restaurants, hotels, hospitals, churches and office buildings to name a few.

In other words, the cost and headache of tearing a structure down in order to build a new one or remodel an old one is going to go up. And, the process for doing so is going to become an even bigger burden.

And that's just one of hundreds of EPA rules making life difficult for heavy construction companies and the architects of those projects.

The solution: Bring in the experts that know how to remove or abate a structure not just cost-effectively, but legally. Yes, that's CES Synergies Inc. Some of its past and current customers have included NASA, the U.S. Air Force, the U.S. Army Corps of Engineers, the State of Florida, and a whole slew of private sector organizations.

CESX has been on a roll, too, fueled by a new expansion effort put into motion just earlier this year. As evidence to that end, CES Synergies Inc. - through its wholly-owned subsidiary Cross Environment Services - generated $5.14 million in revenue last quarter. That compares favorably to the year-ago Q3 figure of $4.38 million. It also compares favorably to Q2's top line of $4.681 million, and to Q1's 3.81 million in revenue. Said another way, the company is growing.

More data was unveiled this week to suggest CES Synergies was going to be even busier in 2015. According to Wednesday's 2015 Construction Outlook from Dodge Data, commercial building should grow 15% next year, up from this year's 14% growth. Institutional building should grow 9% in 2015, led by new school construction. Industrial construction should even perk up next year after a very tough 2014. Industrial construction (think bridges and highways) is projected to grow 5% next year. These are all things that directly bode well for JEC and CBI, but indirectly bode just as well for CESX.

For more on CESX, here's the SmallCap Network's first look.

Tuesday, December 23, 2014

Can Declines In Energy Costs Offset Slowing Global Economies?

Evidence that the slowdown in global economies is beginning to affect the U.S. economy is showing up more clearly in economic reports.

The Commerce Department reported this morning that the U.S. trade deficit jumped 7.6% to $43 billion in September. The culprit was a big decline in exports to important U.S. trading partners Europe, China and Japan. Exports to China fell 3.2%, to Europe by 6.5%, and by 14.7% to Japan. It was the biggest drop in exports in seven months. (Imports were unchanged).

Adding to the problem, the European Commission cut its growth forecasts for the European Union again this morning. The EU says it now expects GDP in the 18-country euro-zone will be up only 0.8% this year, down from its previous forecast of 1.2%, and that growth in 2015 will be only 1.1%.

[Related -Investing In The Smart Home Boom]

Meanwhile, the price of oil, gasoline, heating oil, continues to drop precipitously as supply increases while demand slows with the slowing global economies.

Will the drop in energy costs put enough extra disposable income in the pockets of consumers that domestic buying (65% of the economy) will offset declining exports enough to keep the U.S. economy on its growth track until global economies pick up?

Sunday, December 21, 2014

This E&P Firm Is Attractive Enough

In this article, let's take a look at Cabot Oil & Gas Corporation (COG), a $14.21 billion market cap company, which is an independent oil and gas company engaged in development, exploration and production in North America

Huge Assets

The company´s operations are primarily focused in the Marcellus Shale in Pennsylvania, the Eagle Ford in south Texas and in Oklahoma. The company's asset base is now among the most diverse of the small oil and gas firms.

At the end of last year, the company had reserves of 5.5 trillion cubic feet of equivalent, with net production of 1,130 million cubic feet of equivalent per day. Natural gas represented 96% of production and 97% of reserves.

The firm controls a highly productive, low-cost drilling inventory targeting the dry gas Marcellus shale in Pennsylvania.

The Marcellus Shale

It is the star of the firm, because it is the largest operating area and represents its largest growth and capital investment area, with approximately 200,000 net acres in the dry gas window of the play.

Last year, the production had an increase of 70.3%, from 209.3 Bcfe to 356.5 Bcfe. This number represents about 86% of total production. Further, the gas company invested $815.8 million here and drilled 94.5 net horizontal wells.

Eagle Ford Shale

The company holds more than 60,000 net acres in this oil window at relatively low cost. Last year, production of net liquids and natural gas has increased and represents approximately 3% of full-year production. Further, the firm invested $261.5 million s.

Estimated One-Year Price

According to Yahoo! Finance, the estimated one-year target share price is $42.33, so if you buy shares at current market price ($34.05), your return from price appreciation would be 24.3%. In addition, you have to consider any cash flow received by the asset. So for holding the stock one year, you'll be paid a dividend of 2 cents per share each quarter, totalizing $0.08 at the end of the year. If we divide this number by current price per share, we obtain the dividend yield, which is the other component of the return on an investment for a stock, and in this case is 0.23%. So the total expected return for investing in Cabot is 24.53%, which we believe is an attractive stock return.

Revenues, Margins and Profitability

Looking at profitability, revenue growth by 18.57% led earnings per share increased in the most recent quarter compared to the same quarter a year ago ($0.28 vs $0.21). During the past fiscal year, the company increased its bottom line. It earned $0.67 versus $0.31 in the prior year. This year, Wall Street expects an improvement in earnings ($1.15 versus $0.67).

Finally, let´s compare the best measure of performance for a firm's management: the return on equity. The ROE is useful for comparing the profitability of a company to that of other firms in the same industry.

| Ticker | Company | ROE (%) |

| COG | Cabot | 12.69 |

| ECA | Encana Corp. | 4.59 |

| CPG | Crescent Point Energy Corp. | 1.70 |

| CXO | Concho Resources Inc. | 6.68 |

| EQT | EQT Corp. | 9.68 |

| Industry Median | -1.00 |

The company has a current ROE of 12.69% which is higher than the industry median and the ones exhibit by Encana (ECA), Crescent Point Energy (CPG), Concho Resources (CXO) and EQT (EQT). In general, analysts consider ROE ratios in the 15-20% range as representing attractive levels for investment. It is very important to understand this metric before investing and it is important to look at the trend in ROE over time.

Relative Valuation

In terms of valuation, the stock sells at a trailing P/E of 37.8x, trading at a discount compared to the average of the industry. To use another metric, its price-to-book ratio of 5.8x indicates a premium versus the industry average of 1.86x while the price-to-sales ratio of 7.2x is above the industry average of 4.2x.

As we can see in the next chart, the stock price has an upward trend in the five-year period. If you had invested $10.000 five years ago, today you could have $35.458, which represents a 28.8% compound annual growth rate (CAGR).

Final Comment

With a good asset quality, Cabot is well positioned among the E&P firms, with good number of available drilling locations, reasonable per-unit production costs and not excessive prices.

The Marcellus assets continued to have good productivity and we think this trend will continue. The U.S. natural gas industry could remain under pressure but we think Cabot has good drivers for growth. The Marcellus will reach 90% of Cabot's production in the near future. Moreover, the PE relative valuation and the return on equity that significantly exceeds the industry average and make me feel bullish on this stock.

Hedge fund gurus like Leon Cooperman (Trades, Portfolio), Jean-Marie Eveillard (Trades, Portfolio), John Burbank (Trades, Portfolio), Jim Simons (Trades, Portfolio), Ray Dalio (Trades, Portfolio), Ron Baron (Trades, Portfolio) and John Keeley (Trades, Portfolio) added this stock to their portfolios in the second quarter of 2014.

Disclosure: Omar Venerio holds no position in any stocks mentioned

Also check out: Jean-Marie Eveillard Undervalued Stocks Jean-Marie Eveillard Top Growth Companies Jean-Marie Eveillard High Yield stocks, and Stocks that Jean-Marie Eveillard keeps buying John Burbank Undervalued Stocks John Burbank Top Growth Companies John Burbank High Yield stocks, and Stocks that John Burbank kSaturday, December 20, 2014

Subaru Has Big Plans for the All-New 2015 Legacy Sedan

Subaru's Legacy has long been overshadowed by its iconic sibling, the Outback wagon. But that's about to change: the all-new 2015 Legacy is getting a big marketing push of its own from Subaru. Source: Subaru

How important is the iconic Outback wagon to Subaru? Very.

In fact, it's so important that it tends to overshadow some other strong Subaru models -- like the all-new Legacy sedan.

Back in April, we heard Yasuyuki Yoshinaga, CEO of Subaru parent Fuji Heavy Industries (NASDAQOTH: FUJHY ) , explain why the Outback is central to Subaru's game plan for the U.S. market -- and why the U.S. market is central to the company's global plans.

It's no surprise, then, that the Outback has traditionally received the lion's share of Subaru's marketing efforts. That has helped Outback sales, and the Subaru brand overall -- but to some extent, the Outback's mechanical sibling, the Legacy sedan, has suffered.

The Outback and the Legacy share a great deal under the skin, and they are engineered as a pair. When it's time for all-new models, Subaru tends to release them in quick succession -- but the marketing focus on the Outback tends to overshadow the Legacy.

But Subaru says they're doing it differently this time -- and they're hoping to see some big sales gains for their stalwart sedan. As Motley Fool senior auto specialist John Rosevear explains, Subaru is gearing up to give the all-new 2015 Legacy its own big marketing push -- with some ambitious sales targets in mind.

A transcript of the video is below.

Risk-free for 30 days: The Motley Fool's flagship service

Tom and David Gardner founded The Motley Fool over 20 years ago with the goal of helping the world invest...better. Their flagship service, Stock Advisor, has helped thousands of investors take control of their financial lives and beat the market. Click here to sign up today.

John Rosevear: Hey Fools, it's John Rosevear, senior auto specialist for Fool.com. Subaru is making a very big bet on its all-new 2015 Legacy sedan. Subaru unveiled the all-new Legacy at the Chicago Auto Show back in February, and they've been arriving at dealers over the last several weeks. And now Subaru is launching a huge marketing campaign -- at least, huge by Subaru standards, anyway -- for their all-new sedan.

Automotive News this week quoted Subaru executives as saying that the spending on this campaign would be 150 percent more than any prior marketing effort they've made here in the U.S.

Subaru has of course seen very big growth in the U.S. over the last several years, the compact Impreza and the Forester have seen big gains, as has the Legacy's sibling, the Outback wagon. But Legacy sales haven't grown as much as those other products. Part of the problem is that people think of Subaru as the all-wheel-drive brand, they're just naturally drawn to products like the Forester and the Outback, and I think the Legacy kind of gets overlooked.

But as we reported earlier this year, the new Legacy is a little bigger than the old one, a little roomier, and loaded with up-to-date high tech safety features. And apparently, Subaru now thinks it's ready to go head-on with the big-name midsize sedan contenders.

Now, aside from full-size pickup trucks, midsize sedans make up the biggest market segment in the U.S. auto market. And there are four big sellers here, Toyota's (NYSE: TM ) Camry, Honda's (NYSE: HMC ) Accord, Nissan's (NASDAQOTH: NSANY ) Altima, and Ford's (NYSE: F ) Fusion. The Legacy has been just a tiny player in that market.

Last year, Subaru sold just over 42,000 Legacys in the U.S., a tiny number compared to the 408,000 Camrys that Toyota sold, or even the 234,000 Focuses that Ford sold. But Subaru seems to think they have an opportunity to gain some ground. Subaru's U.S. marketing chief Bill Cyphers told Automotive News that the company is aiming to sell 60,000 Legacys over the next 12 months, that would be almost a 50 percent increase from 2014 sales.

But Subaru isn't aiming to get that gain by being aggressive on price. Subaru's incentives on the new Legacy are less than $1,000 per car, pretty small in this segment, and Subaru isn't planning on boosting them to chase sales. Instead, they're looking to the increased strength of the brand that has come as sales have increased over the last few years, the strength of their new product, and a traditional marketing campaign.

That campaign will feature a series of TV commercials running from now through September. Those commercials include a new tag line: "The Legacy is not just a sedan, it's a Subaru."

So can they really boost Legacy sales by close to 50% over the next year? I'm thinking that they probably can, they've got an opportunity with a solid new product and they're putting some marketing muscle behind it, it's a classic formula for success, but we'll find out. Thanks for watching.

Xerox Corp Selling IT Outsourcing Unit for $1.05B (XRX)

Before the opening bell on Friday morning, it was announced that French company Atos SA will buy Xerox’s (XRX

) IT outsourcing unit for $1.05 billion in cash.

) IT outsourcing unit for $1.05 billion in cash.

Atos SA is a computer services firm, and its purchase of this Xerox unit will give the France-based company a stronger foothold in the U.S. Xerox’s IT outsourcing unit has annual revenues of $1.5 billion. The deal is expected to close during the first half of 2015.

Xerox stock was up 52 cents, or 2.59%, in pre-market trading. YTD, the stock is up 14.13%.

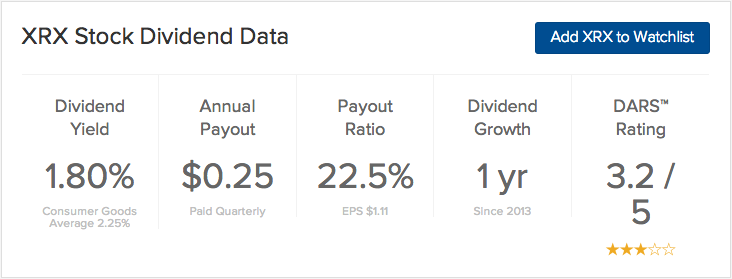

XRX Dividend SnapshotAs of Market Close on December 18, 2014

Click here to see the complete history of XRX dividends.

Friday, December 19, 2014

Fed's Plosser: Federal Reserve Must Prepare Markets for Rate Increases

Federal Reserve Bank of Philadelphia President Charles Plosser said Friday that the U.S. central bank needs to start preparing markets for increases in short-term interest rates that may come sooner than many currently expect.

“We need to adjust the language in our statement to reflect that the economy really is better that it was, and that the necessity of having zero interest rates for a long time to come seems to me to be perhaps a risky or unnecessary step at this point,” Mr. Plosser said in an interview with The Wall Street Journal.

“I don’t know if we need to tighten policy right now, but it’s pretty clear to me” the economy has improved in a way that central bankers need to get ready for the coming end to the Fed’s ultra-easy money stance, he said.

Mr. Plosser’s comments came from an interview held on the sidelines of a conference held by the Global Interdependence Center in Jackson Hole, Wyo. He weighed in at a time of shifting expectations about the outlook for monetary policy.

Rapid improvements in the state of the labor market and some signs inflation may be starting to stir higher are driving many in financial markets to expect that the Fed may increase interest rates sooner than had been thought.

Fed officials widely agree that the first increase in what are now near-zero-percent short-term rates will happen some time next year, in a long-held view. A number of officials have indicated that the increase most likely would occur around midyear and maybe even after. But some central bankers, much like those in financial markets, are beginning to gravitate to the view that rates could rise sooner than they have been projecting.

Mr. Plosser, who currently holds a voting slot on the monetary policy-setting Federal Open Market Committee, long has been uncomfortable with the ultra-easy stance of monetary policy. He also has said in past that the Fed should contemplate raising interest rates sooner rather than later.

In the interview, Mr. Plosser said that while he knows it is unlikely to happen, he would prefer for the Fed to lift rates this year and close out 2015 at a 1% short-term rate level, with rates at 3% by the close of next year.

He said that while it is a matter that is up for debate, he believes the Fed needs to change its policy statements in a way that won’t suggest rates will rise at some distant point in the future. The Fed now pledges to keep rates near zero for a “considerable period” after the end of its bond-buying program, and Mr. Plosser believes language like that needs to be done away with.

Mr. Plosser also addressed the June Fed meeting minutes, which were released Wednesday. The document showed officials hashing out the technical details of how they will raise rates in a world where the financial system is flooded with reserves. The Fed traditionally has adjusted back reserves to achieve the desired level of short-term rates.

The Fed will have to follow a different path when it increases rates given this situation. Mr. Plosser explained that it is possible the Fed may have to change how it defines the level of short-term rates given the current state of what is called the fed funds market, where banks borrow and lend reserves. The fed funds target rate long has been the central bank’s primary expression of the state of monetary policy.

“I’m open to the idea that maybe there’s a different definition” of the Fed’s short-term rates goals. He said it is possible that the Fed may combine a number of different rates, for example market-based fed funds rates with rates from the Eurodollar market–in a bid to target the overall level of short-term rates.

“We really don’t have to have precise control over every short-term interest rate in the marketplace” for monetary policy to work, Mr. Plosser said. The Fed may be able to work just as well with a new aggregate of market rates, although he noted this is still very much a matter of debate among policy makers.

“You may still have an effective funds rate, but that may be only one piece of what we might describe as the overall general level of short-term rates,” the official said.

Mr. Plosser also said the low level of volatility in most financial markets right now makes him “nervous.” He added, “I’m not sure low volatility is necessarily a healthy thing. There are risks out there” and traders and investors shouldn’t be complacent about that.

Follow @WSJecon for economic news and analysis

Follow @WSJCentralBanks for central banking news and analysis

Get WSJ economic analysis delivered to your inbox:

Sign up for the WSJ's Grand Central, a daily report on global central banking

Sign up for the Real Time Economics daily summary

Wednesday, December 17, 2014

Wealthfront CEO sees his robo-adviser as the next Schwab

Robo-adviser Wealthfront has proudly vaunted its recent crossing of the $1 billion mark in assets under management, but it remains to be seen whether the startup will achieve its goal of becoming a Charles Schwab-like investment firm for Millennials.

Wealthfront chief executive Adam Nash says $1 billion in just two and a half years marks a gratifying milestone that showcases the startup's innovative focus on automated, low-cost and index-based investing. Indeed, he openly compares Wealthfront's innovative business model to The Charles Schwab Corp., and says it will do for Millennials what the discount brokerage did for baby boomers in the 1970s — namely, bring low-cost investing to a huge audience.

“If you look at history, every generation in the U.S. tends to look at investing differently than their parents' generation. What Charles Schwab found was that the only people who wanted to invest over the phone was people in their 20s and 30s,” Mr. Nash said.

He added that Charles Schwab himself told Wealthfront co-founder Andy Rachleff in 2012 that he saw parallels between what his firm had done and what the startup is now doing.

Schwab spokeswoman Susan B. Forman wrote in an e-mail that she didn't have any comments on Wealthfront's business model.

But robo-naysayers believe Wealthfront is no Schwab.

Schwab had a unique, once-in-history opportunity when it launched the discount brokerage in 1975, after commissions were deregulated, said Michael Kitces, a partner and director of research at Pinnacle Advisory Group Inc. and author of the Nerd's Eye View blog.

“Wealthfront hasn't had any significant regulatory events that created a blue ocean that never existed before,” Mr. Kitces said.

And according to Alex Murgu�a, managing principal at McLean Asset Management Corp. and chief executive of financial planning software firm inStream Solutions, if Wealthfront's future resembles anything Schwab-like, it will more likely be th

Thursday, December 4, 2014

ADP: Private Sector Adds 208,000 Jobs in November

Lynne Sladky/AP WASHINGTON -- U.S. private employers added jobs at a fairly brisk clip in November, suggesting a slowing global economy is having a limited impact on domestic activity. The steady pace of hiring, however, has yet to translate into stronger wage growth. Other data Wednesday showed sharp downward revisions to compensation in the second and third quarters, suggesting the Federal Reserve had room to maintain its low interest rate policy for a while. The ADP National Employment Report showed private payrolls increased by 208,000 last month. While that was slightly below Wall Street's expectations for an increase of 221,000 jobs, October's payrolls were revised to show 3,000 more positions added than previously reported.

The labor market continues to make steady progress.

Private employers have now added jobs for 57 straight months at an average rate of about 186,000 per month. "The labor market continues to make steady progress," Ahu Yildirmaz, vice president and head of the ADP Research Institute, said on a conference call following the release of the data. In separate report, the Labor Department said unit labor costs, the price of labor for any given unit of production, fell at a 1 percent rate in the third quarter. They had previously been reported to have increased at a 0.3 percent pace. Unit labor costs for the second quarter were also revised down to show them declining at a steeper 3.7 percent rate instead of the previously reported 0.5 percent pace. That should ease fears that wage growth is rising a little bit faster than the Fed's expectations and cause the U.S. central bank to wait longer to raise interest rates. U.S. Treasury debt prices rose on the data. U.S. stock index futures were little changed, while the dollar was up against a basket of currencies. Wage growth is one of the key factors that will determine when the Fed will start raising its short-term interest rate, which it has kept near zero since December 2008. Compensation per hour increased at a 1.3 percent rate in the third quarter rather the 2.3 percent pace reported last month. Compared to the third quarter of last year, hourly compensation rose 2.2 percent instead of the 3.3 percent advance reported last month. Nonfarm productivity, which measures hourly output per worker, expanded at a 2.3 percent annual rate instead of the previously reported 2 percent pace. -.